April 14, 2023

If utilities continue investing into gas pipeline infrastructure at a business-as-usual rate, even as our climate policies lead people to use less gas, base rates could increase to levels that wouldn’t be affordable for the average family.

Across the West, many residents received substantially higher energy bills this winter, and the outcry has prompted policymakers across the region to probe the causes. Amidst growing inflation across the U.S., utility rates have become a key economic and equity issue. In Colorado, customers have seen bills two to three times higher than last year, and both Colorado’s Public Utilities Commission, which regulates natural gas and electric utilities, and Colorado’s legislature have held hearings on the causes of the price spikes.

The reason lies in our reliance on natural gas, which many households across the region use for space and water heating. This winter, gas wholesale prices skyrocketed nationwide — and on top of these increases, ballooning investments in fossil pipeline infrastructure raised bills for customers.

Focusing on Xcel Energy, the largest utility in Colorado that serves some of its biggest cities along the Front Range, including the Denver metropolitan area, let’s dive into why natural gas is the culprit in these price hikes. Although electricity rates have increased, gas bills account for about 80% of the overall increase in bills for the average customer in Colorado this winter, according to the Colorado Public Utilities Commission staff.

While the underlying causes of high gas bills are multi-faceted, generally there are two components of a gas bill: fuel costs and infrastructure costs, which include both capital costs and ongoing operation and maintenance costs. Because the fuel costs of gas utilities are tied to global markets, regulators cannot directly control them, though they can require utilities to invest in energy efficiency to reduce customers’ fuel use. However, gas utilities – and their regulators – can directly influence a utility’s investments in infrastructure by evaluating planned investments against cleaner alternatives.

Fuel Costs

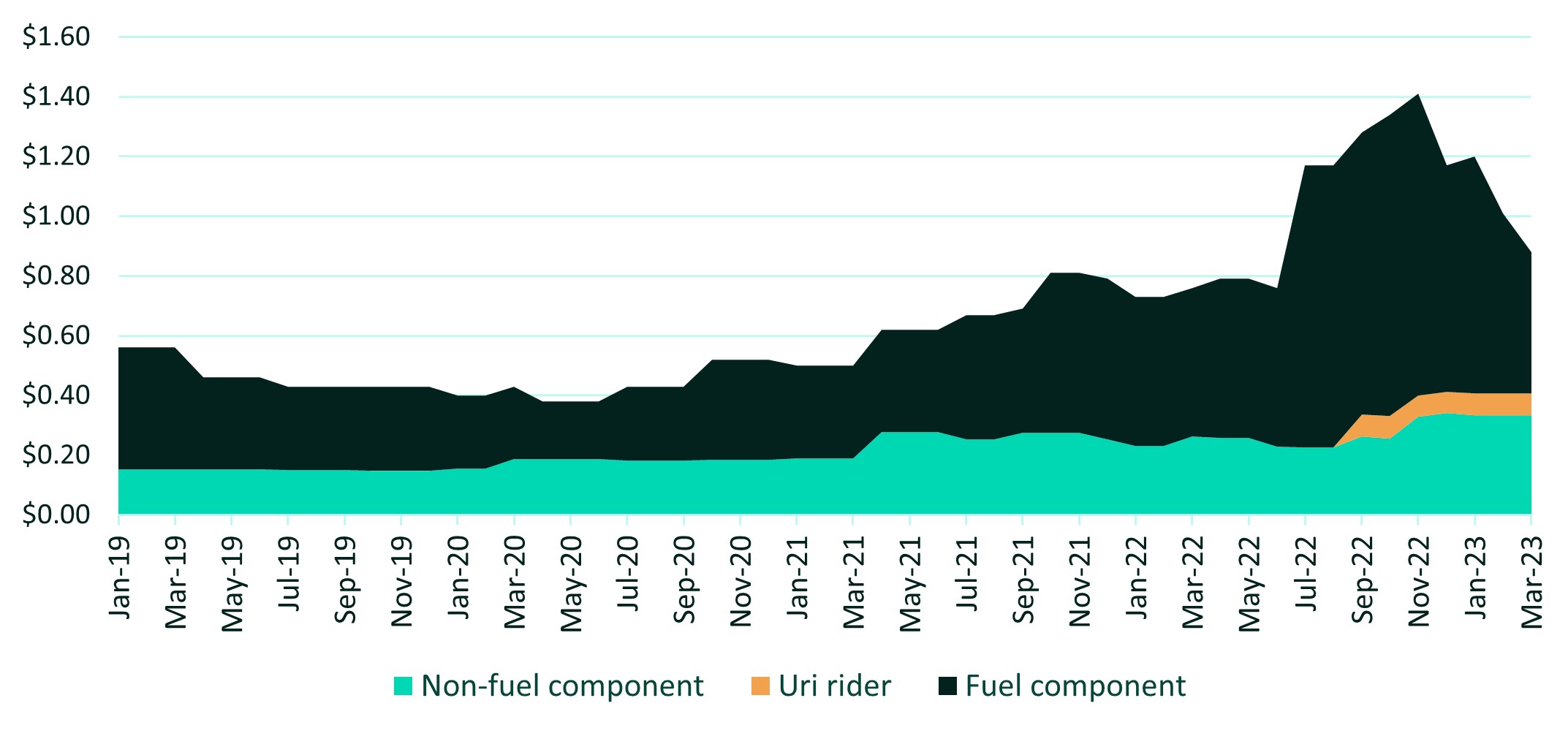

Gas has become much more expensive. The figure below shows the rate that Xcel Energy’s residential customers pay per therm (a unit of heat) of gas they use, leaving out the fixed $10 charge that customers pay for gas service each month. In the summer and fall of 2022, this rate nearly doubled compared to the spring of 2022. Relative to 2020 rate levels, the rate in late 2022 tripled.

Xcel Energy: Volumetric Residential Gas Rates by Component

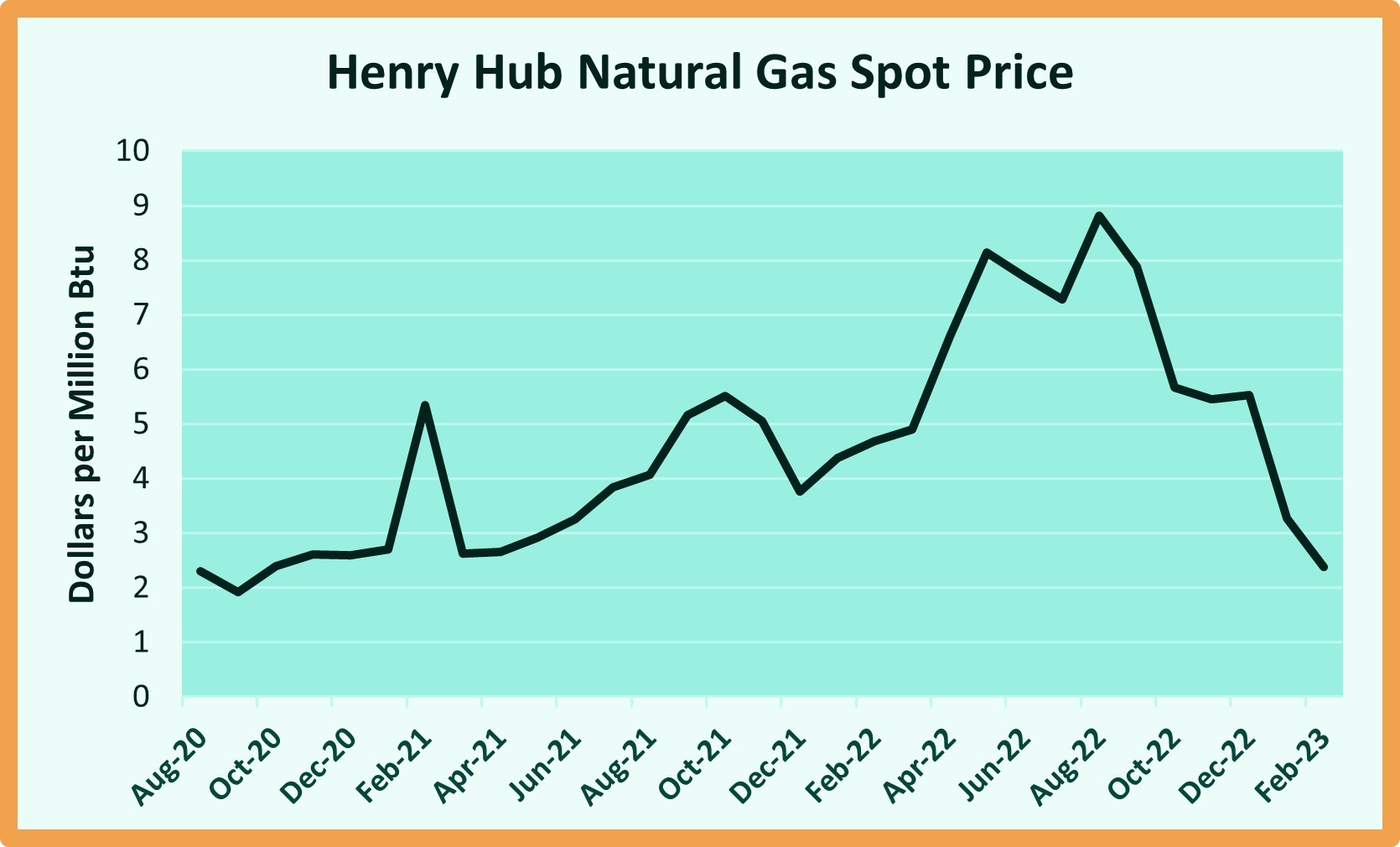

A big part of this trend is that the cost of the fuel itself — shown in the top bar above — has temporarily become more expensive. The Russian invasion of Ukraine has squeezed gas markets in the United States and Europe, as Europe has demanded more gas exports from the U.S. During the summer of 2022, the Henry Hub spot price for gas skyrocketed from around $4 per MMBtu in December 2021 to almost $9 per MMBtu by August 2022, the highest level since 2008.

According to the Colorado PUC, another reason why bills are higher is that Coloradans are using more gas. Gas demand was about 30% higher in December 2022 than in December 2021, owing to unusually cold weather. On Dec. 22, temperatures in Denver plunged to -24 degrees Fahrenheit, the lowest level recorded since 1990.

While Coloradans are paying more for gas itself, other components of their gas bill are also increasing. Since September 2022, customers of Colorado utilities have been paid an “Extraordinary Gas Cost Recovery Rider.” This rider allows utilities to collect millions of dollars from ratepayers to pay for fuel they purchased at sky-high prices during Winter Storm Uri in February 2021. For Xcel customers, paying back this amount will cost customers an average of $7.20 per month on their gas bills.

Finally, volumetric base rates — the non-fuel portion of gas utility rates that pay for operations, maintenance, and transmission and distribution pipeline infrastructure — have also doubled since 2019. To explain why, we’ll need to provide a short explanation of how gas utility “cost of service” ratemaking works.

Infrastructure Costs

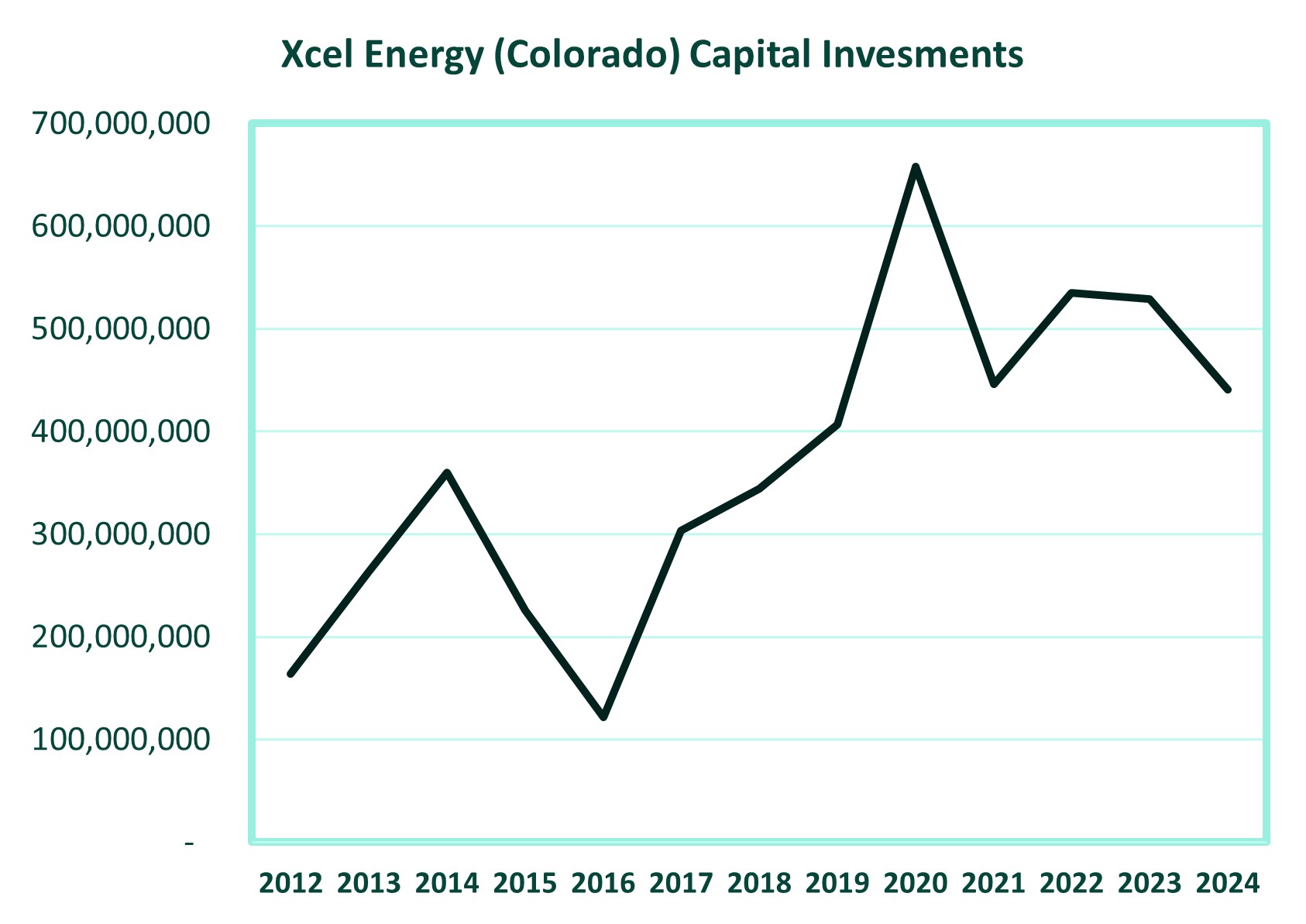

Gas utilities don’t just pay for the actual gas they provide to their customers; they also pay for the infrastructure they use to transport and distribute gas, like pipelines, meters, and pressure regulators. This infrastructure needs to be built, maintained, and sometimes repaired or replaced. Xcel invests hundreds of millions of dollars per year into its infrastructure base.

Like a home mortgage, ratepayers pay off that infrastructure over time. Additionally, ratepayers pay a rate of return on those investments, which goes to shareholders and bondholders of the utility company. In other words, a utility’s profit comes from its capital investments — not its fuel costs or operations and maintenance costs.

All of this goes into the utility’s revenue requirement, which is the total amount of money that the utility needs to collect from ratepayers each year to break even.

Over the past decade, the amount of Xcel’s capital investments has accelerated dramatically. Although investment has been volatile from year to year, incremental annual investments have soared from an average of $227 million between 2012 and 2016, to over $650 million in 2020. Spending is projected to remain high — over $400 million each year through 2024.

When setting rates for customers, the utility spreads the revenue requirement across its sales by customer class. Think about splitting a restaurant bill across an entire table — the more people chipping in, the lower each person’s share. Likewise, the more gas the utility sells, the less it needs to charge per therm to cover the cost of its capital investments and meet its revenue requirement. When the revenue required to cover new investments outpaces sales growth, which appears to be the case within Xcel’s service territory recently, customer rates increase.

How will rates change in the future?

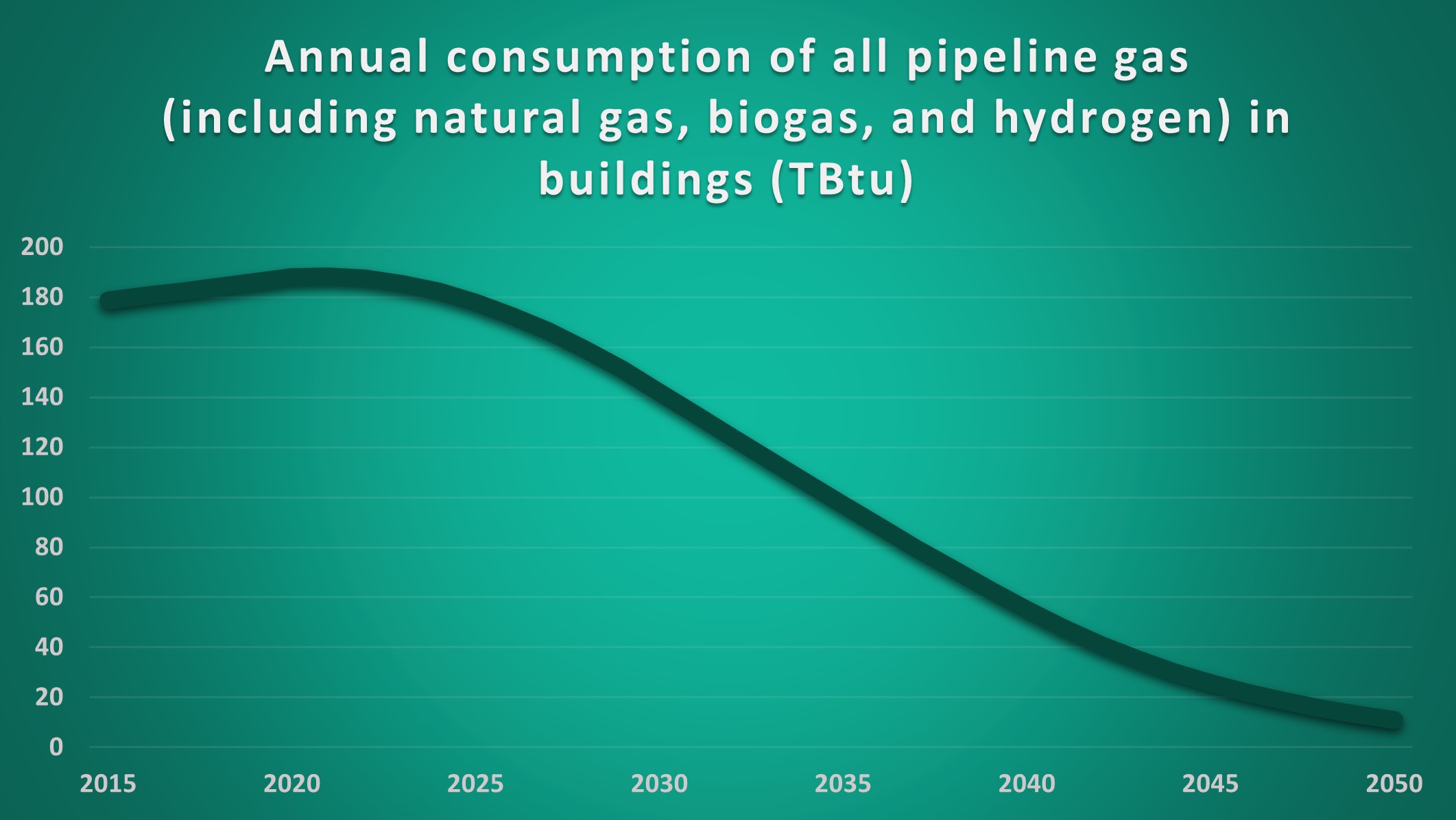

Xcel currently plans to pay off its investments over an average lifetime of almost 60 years. This means distribution pipelines installed today will not be paid off until 2080. At the same time, Colorado has enacted a suite of policies aimed at reducing the use of fossil fuels like gas. To meet Colorado’s mid-century climate goal, under which the state would reduce its greenhouse gas emissions 90% by 2050, households will need to transition from burning gas to using electricity for heat. The Colorado Greenhouse Gas Roadmap projects that sales of all pipeline gas will plummet through 2050.

A sharp decline in fossil fuel use protects the climate and protects households from volatile fossil fuel prices like those we’ve seen this winter. However, if consumption of pipeline gas declines, but investment in pipeline gas infrastructure remains constant, fewer customers will be paying for the utility’s investment costs.

Recall the restaurant tab analogy: customer rates are calculated by spreading a tab (the revenue required to recover the utility’s investment) over the people sitting at the table (the utility’s energy sales). If all but one person leaves the table before the bill comes due, the person remaining will foot a steep bill.

According to a modeling analysis by E3, if utilities continue investing into gas pipeline infrastructure at a business-as-usual rate, even as our climate policies lead people to use less gas, base rates could increase to levels that wouldn’t be affordable for the average family. In the study that E3 developed for the state of California, electrification causes total gas system use to decline by about half by 2050. As a result, average gas volumetric rates climb by about four-fold in this scenario without any measures to manage the gas transition.

To be clear: these modeling results do not reflect good policy or a successfully managed transition away from gas. Across the Interior West, states and local jurisdictions have adopted ambitious, science-based climate goals. A key part of reducing emissions from the built environment is replacing gas-fired furnaces and water heaters with clean, efficient, electric heat pumps and heat pump water heaters. State policies – along with federal incentives – can accelerate this transition. But to prevent future rate increases and manage the ongoing risk of volatile fuel costs, utilities must stop investing in gas pipeline infrastructure and instead invest in alternatives like efficient electric space and water heating and energy efficiency. Coloradans deserve the clean, affordable energy that renewable sources and energy efficiency provide. We’re working with lawmakers, regulators, and utilities to prioritize a clean energy future that allows Western communities to thrive rather than struggle under the burden of high energy bills.