November 7, 2025

For more than a century, electricity systems in the West have operated like a patchwork quilt with a hodgepodge of independent operators; some span entire states and some control only small footprints. As wholesale electricity markets expand into the West, there is an opportunity for greater efficiency and standardization, but a new challenge has emerged: seams. Created when energy transactions occur across multiple, adjacent markets, managing seams will be essential to realizing the promise of a more efficient, economic, and interconnected Western electricity grid .

What are Seams?#

Seams are a challenge to be mitigated and addressed on an ongoing basis wherever people are buying or selling electricity across multiple wholesale energy markets. They can’t be fully eliminated; they can only be mitigated through thoughtful planning and comprehensive agreements between market operators. If managed poorly, seams will make the grid less efficient and energy more expensive.

To best understand seams, imagine that Phoenix and Tempe come up with separate requirements for things like cell phone carriers or postal service. The differences between how both cities operate would need to be diligently managed with steady cooperation and open lines of communication. Without that, you would have a complex, opaque mess of systems that would prevent both cities — and potentially the surrounding region — from maximizing the efficient sharing of resources, driving up costs.

Without cooperation between numerous parties, like PacifiCorp and Arizona Public Service, seams can create significant setbacks — and can erode the consumer and environmental benefits that come from utilities joining day-ahead markets and regional transmission organizations (RTOs). Seams can result in a less reliable system and may adversely impact energy and capacity trading, energy reserve sharing arrangements, resource adequacy programs, and resource and transmission expansion.

The Root Cause of Seams: Competing Energy Markets#

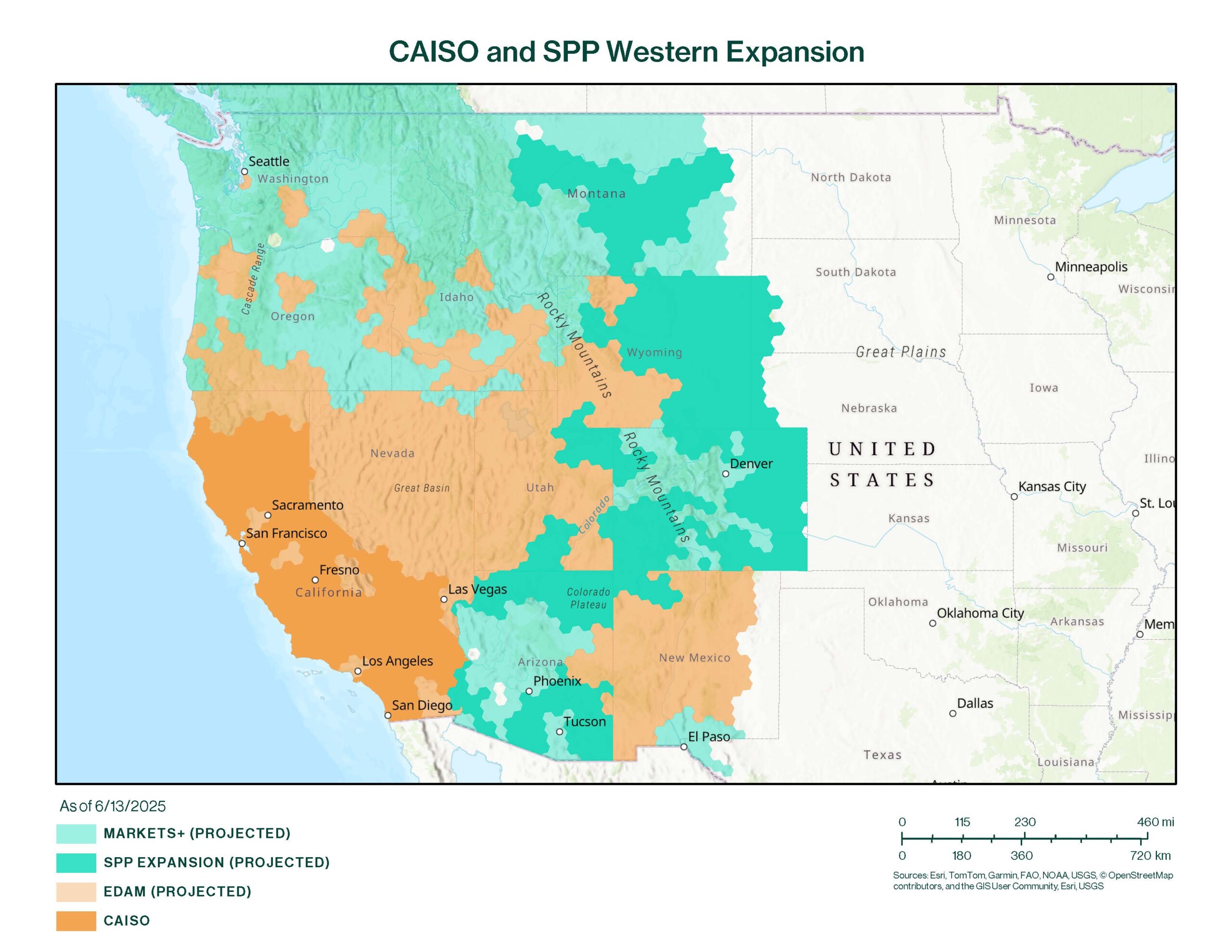

Within the Western Interconnection, our region’s grid, the only system managed by a centralized market operator is the California Independent System Operator (CAISO), which covers most of California and a small part of southern Nevada. The remaining region is managed by approximately , each responsible for ensuring that supply meets demand to maintain reliability within their footprint.

A regional energy market is managed by a grid operator using highly sophisticated software, monitors, and computers that allow them to see the way electricity flows across the grid. This allows the transmission system to be more fully and efficiently utilized, reducing the need to build expensive new transmission. Making more efficient use of the existing grid not only saves money, but it also avoids potential harm to recreation areas, habitats, endangered species, and iconic landscapes.

Two of the country’s largest electricity system operators — Southwest Power Pool (SPP) and CAISO — are offering competing day-ahead energy markets to utilities across the West. In a day-ahead market, participants purchase and sell energy for operations the following day. This is similar to many financial markets; here, utility operators anticipate their energy needs for the next day and determine if they will need to purchase any from another utility, or if they will produce a surplus that can be sold to utilities looking to buy. Day-ahead markets allow buyers and sellers to hedge against price volatility by locking in energy prices before the scheduled day of trades.

In any regional transmission organization, all the balancing authorities within that geographic area are consolidated into one, allowing for greater information sharing, enhanced grid reliability, and lower costs.

SPP is working to expand its regional transmission operations into the Western Interconnection with its market offering. RTO West will connect SPP’s Eastern Interconnection, and Western Interconnection regions will be linked by three direct current interties that total 510 megawatts. The company plans to launch RTO West on April 1, 2026.

Day-ahead markets span much of the country east of the Mississippi River. In the West, sellers of electricity must enter into contracts in a real-time market to move power from one location to another over long distances. For example, a utility in Montana may have power to sell to a utility in San Diego. To move that power, the utility may contract with multiple transmission operators through Oregon and California. However, since electricity follows the laws of physics rather than contracts, this electricity may flow south through Utah rather than the contracted Oregon/California path. This may unexpectedly overload and stress that part of the grid. To protect against this type of overloading, the lines in Utah may routinely be operated well below their full capability.

Day-ahead markets help utilities break out of silos of serving only those customers within their borders. By working together, utilities can reduce the number of generators that must be started at the beginning of each day, reducing reliance on expensive fossil fuels and consequentially reducing emissions. Utilities in a day-ahead market benefit from expanded transmission connectivity, increased reliability benefits, and greater access to diverse clean resources across multiple states.

Solving for Seams#

Nearly every part of the industry will experience the impacts of market seams: market operators, grid operators, resource and transmission planners, operating and capacity reserve sharing program participants, and market participants. Many entities will have a role in identifying and managing the adverse impacts of seams. A is needed to evaluate whether a market’s policies and practices mitigate the impact of seams. In-depth conversations among impacted stakeholders and the markets developing in the West should begin now.

In a new report prepared for WRA, Grid Strategies gives recommendations that specific market entities can undertake to manage the potentially adverse impacts of seams.

Balancing Authorities#

Responsible for managing the grid operations of its specific region, a balancing authority can be a utility, power market administrator, regional transmission organization, or an independent system operator.

Specific recommendations for balancing authorities include:

- Analyzing, revising, or negotiating new coordination agreements to ensure compatibility with new markets and address new seams.

- Assessing the performance and financial implications of market seams for reserve sharing arrangements — agreements between neighboring balancing authorities to collectively maintain and share operating reserves.

Market Operators#

Responsible for operating an organized market for the commercial exchange of energy and services on behalf of market participants. Examples include CAISO and New York ISO.

Specific recommendations for market operators include:

- Establish interface prices — the cost of electricity at a specific location that connects different parts of the power grid. These price points are used for trading electricity between market areas or balancing authorities.

Transmission Customers and Market Participants#

Transmission customers are typically utilities that purchase wholesale power and use high-voltage transmission lines to transport that electricity to the local distribution system. Market participants are businesses that trade on the wholesale market for electricity,

Specific recommendations for transmission customers and market participants include:

- Evaluate existing contractual arrangements to identify potential changes to address financial exposure if the contract requires delivery across a market seam.

- Update resource planning processes and tools to reflect realistic assumptions about availability and cost of energy imports.