September 8, 2023

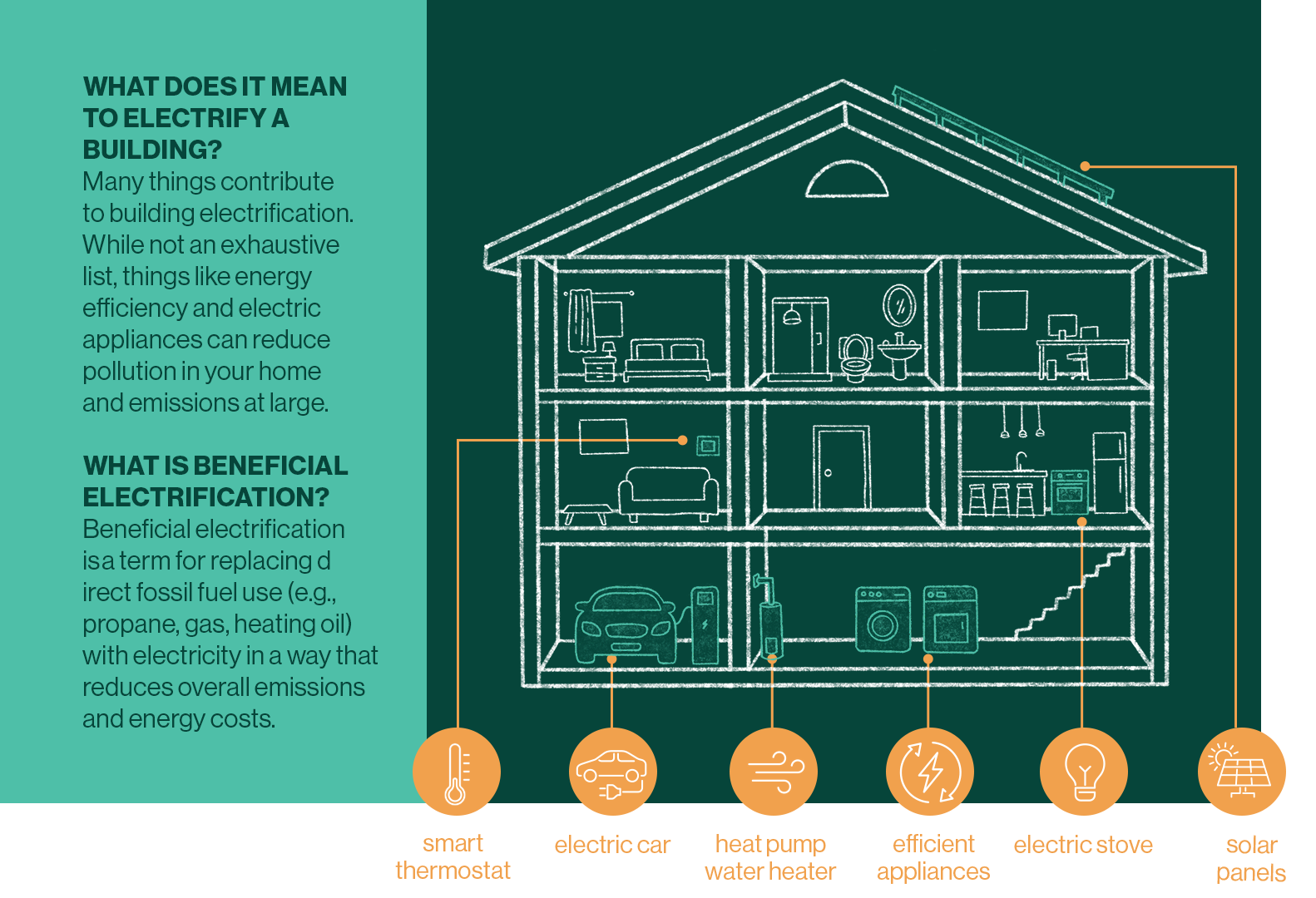

Many states in the Interior West have ambitious goals to bring their greenhouse gas emissions to zero by 2050. This is undoubtedly a paradigm shift, and not one that can be achieved overnight. The transition to a zero-emission future requires transforming the way we use energy, including in our homes and buildings.

With strong regulatory agencies and lawmakers committed to policies that will enable the state to hit net zero by 2050, Colorado is implementing multiple policies to reduce greenhouse gas emissions from the built environment. For example, in 2021, Colorado passed , legislation establishing a goal for Colorado’s gas utilities to reduce their greenhouse gas emissions by 4% by 2025 and 22% by 2030, relative to 2015 levels. Those emission reductions apply to both the gas delivered to households and commercial businesses, and the gas that is leaked from the utility’s distribution system.

In July, WRA, NRDC and SWEEP published a report in which we recommend measures to drive a steep reduction in emissions from Xcel Energy, Colorado’s largest gas provider, and demonstrate how the utility can meet Colorado’s targets in a way that delivers the most emissions reductions per ratepayer dollar. We concluded that Xcel must help customers rapidly increase adoption of efficient electric appliances – heat pumps and heat pump water heaters.

WRA hosted a webinar in August to discuss the findings of our report. Featuring a panel of clean energy experts, the webinar prompted more questions than we have ever received during such a presentation. Decarbonization is a complex topic with many facets, and the answers to some questions can fast become overwhelmingly technical.

In this blog post, we answer not only many of the questions asked during our webinar, but other questions our experts are asked in their daily work in the field. We hope this Q&A helps customers and decision makers alike as we work toward a future of renewable energy, cleaner air, and improved public health for all.

While our report and webinar focused on Colorado, many of the concepts discussed apply to other states, both in the West and beyond. In the answers below, we cite a broad range of references and studies to illustrate common solutions.

Click below to see your questions on decarbonization answered by WRA’s experts.

Clean Heat Resources

Clean Heat Resources

According to U.S. Census data, 68% of households in Colorado use gas and 24% use electricity. More homes in Colorado use gas than the national average: 47.5% of homes in the U.S. use gas for heating and 39.8% use electricity.

Here’s how the other states within WRA’s region break down:

- Arizona: 33.2% gas, 60.1% electric.

- Montana: 52.3% gas, 24.9% electric.

- New Mexico: 62.4% gas, 22.3% electric.

- Utah: 80.4% gas, 15.1% electric.

- Wyoming: 59.8% gas, 23% electric.

With the building efficiency and electrification measures that we propose to meet Colorado’s clean heat standard, we project that by 2030, 100% of all new homes within Xcel’s service area will be all-electric, and nearly 30% of Xcel’s residential customers will have a heat pump for space heating (standard or cold-climate).

Established by SB-264, Colorado defines the following measures and resources as clean heat resources that a utility can use to meet the clean heat standard. This standard requires gas utilities in Colorado to reduce greenhouse gas emissions from distribution pipeline leaks and burning gas in buildings by 4% by 2025 and 22% by 2030 from a 2015 baseline.

- Gas demand-side management. According to the U.S. Energy Information Administration, demand-side management (DSM) programs consist of the “planning, implementing, and monitoring activities of electric utilities which are designed to encourage consumers to modify their level and pattern of electricity usage.”

- Recovered methane measures, defined as:

- Biomethane or “biogas”, which is produced from decaying organic matter — such as animal manure, waste in landfills, or waste treated at municipal wastewater treatment plants — through a process called anaerobic digestion. According to the Department of Energy, biomethane can be used as a replacement for traditional geologic gas, a fossil fuel.

- Coal mine methane — capturing and using the methane released from coal due to mining activities.

- Methane that would have leaked without repairs of the gas distribution and service pipelines.

- Pyrolysis of tires (if the pyrolysis meets a recovered methane protocol).

- Beneficial electrification, defined in Colorado law as conversion to a high-efficiency electric fuel source in a way that reduces net greenhouse gas emissions and reduces societal costs or provides benefits for the electric grid.

- Finally, utilities can use any technology that the Colorado Public Utilities Commission finds is cost-effective and results in a reduction in carbon emissions from the combustion of gas in customer end uses to comply with clean heat targets.

Also called “responsibly sourced” natural gas, certified natural gas is reviewed by a third party that claims that certain sources of gas are produced in a way that is less harmful to the environment than standard gas production. In May 2021, Xcel Energy announced it would purchase Project Canary-certified natural gas from Crestone Peak. Certified natural gas is still methane and a fossil fuel — which means it emits just as much CO2, NOx, and other pollutants into the atmosphere as “regular” natural gas when burned. It therefore continues to contribute to climate change and respiratory ailments. As the Sightline Institute puts it: “At best, [certified gas] is to regular gas as low-tar cigarettes are to regular smokes: marginally less dangerous but no one’s idea of a healthy choice for the long term.”

Certified natural gas is not regulated, and there are no standardized criteria for meeting a “certified natural gas” standard. Although certifiers such as Project Canary claim that certified natural gas reduces methane leaks from upstream production and transportation, there is no established protocol for ensuring that these reductions are additional to the methane reductions that are already required by law. This is especially relevant in Colorado, where state regulations already require more frequent methane leak detection and repair than the industry average, as well as reductions in greenhouse gas intensity from upstream operations. As a result, certification only adds value and reduces climate pollution if it requires producers to go above and beyond Colorado regulations — otherwise, it just duplicates the state’s efforts.

Carbon offsets are emissions reductions that a business pays to obtain from elsewhere, to compensate for emissions from its own operations. For example, a company could fund a reforestation project to help counter ecological damage done in areas with active logging.

While the benefits of carbon offsets are debated by climate scientists and policy analysts – and some companies like Shell that once touted large offset programs have abandoned them – offsets do not reduce carbon emissions from the combustion of gas in buildings, nor do they reduce emissions from methane leakage. And carbon offsets can result in a shifting of emissions-causing activity. In the example above, if a reforestation effort stops logging in one area, it can simply shift to another. For the company, the reforestation project could meet its carbon offset goals – but total carbon emissions will not have changed.

Carbon offsets face other significant challenges. It is difficult to verify that offsets are real, incremental and provide permanent emissions reductions. Without comprehensive GHG emissions caps that span the economy, accurately verifying whether an offset program shifts emissions elsewhere is also difficult. And there are currently no carbon offset programs with a focus on Colorado. Therefore, it is likely that any offsets procured by a company would occur outside of the state borders without any benefit flowing to Colorado residents.

GAS SYSTEM PLANNING

GAS SYSTEM PLANNING

Certified natural gas is not a solution to decarbonize the gas system. As we explain above, certified gas is not chemically different from “regular” gas — when burned, it all emits the same amount of carbon dioxide, and when leaked from pipes or appliances it emits the same amount of methane. Both carbon dioxide and methane harm public health and our environment. To reach state greenhouse gas emissions targets and ultimately achieve net zero emissions, utilities must transition away from the use of gas rather than invent justifications for its continued use.

It’s also important that fossil fuel companies don’t use carbon offsets to justify continued use of fossil fuels as energy resources, which runs counter to the steps utilities should take to reduce greenhouse gas emissions.

The accelerated adoption of appliances using electricity instead of gas is the most cost-effective way to decarbonize our gas systems. This is especially true as Colorado electric utilities are required to reduce the greenhouse gas emissions associated with electric generation by 80% from 2005 levels by 2030, meaning that the electricity powering heat pumps and heat pump water heaters will increasingly come from renewable resources such as solar, wind and battery storage in the coming decade.

Yes. In fact, continuing to provide safe and reliable service is the point of non-pipeline alternatives. Gas utilities like Xcel plan to spend hundreds of millions of dollars before 2030 on pipeline infrastructure whose purpose is to serve new customer growth. This growth can be avoided by redirecting potential customers — including new home developers — toward efficient electric alternatives. Avoiding new pipeline capacity not only avoids millions of dollars of expenditures in the short term — it also avoids maintenance costs required to preserve safety and reliability in the long term. Even as gas utilities decarbonize, they must continue to meet state and federal standards for safety and reliability.

Gas utilities have already begun implementing non-pipeline alternatives in other states. New York’s Public Service Commission, for example, adopted an order last year requiring gas utilities to examine alternatives to all planned gas utility projects and provide a detailed justification for projects for which they cannot avoid building out pipeline infrastructure. Consolidated Edison (ConEd), a large utility in New York, has issued requests for proposals for non-pipeline alternatives since 2017. In 2019, the Public Service Commission approved a package of over $200 million in non-pipeline alternatives to serve ConEd’s customers in the New York City metro area, where the utility had imposed a moratorium on new natural gas hookups.

Yes. Again, ConEd of New York provides an example. Following Superstorm Sandy – a massive storm that hit the city in late October 2012 and caused 43 deaths and $19 billion in damages – ConEd spent seven years on a study to guide how it will factor the impacts of climate change on its work to meet New York’s goal of net zero by 2050. Beneficial electrification emerged as a key component of both ConEd’s decarbonization goals and its core mandate to provide reliable power to the largest metropolitan region in the U.S.

In 2022, ConEd invested $1.8 billion in its electric transmission and distribution systems in New York City and Westchester County, replacing many transmission lines. ConEd says it will invest roughly $2.3 billion in 2023 on continued improvements in system safety, reliability, and resiliency, “while continuing to invest in infrastructure upgrades needed to support clean energy goals.”

According to the Department of Energy, the amount of renewable resources available in the U.S. is 100 times that of the country’s annual electricity demand. The replacement of gas with renewable energy, and measures like beneficial electrification and energy efficiency, reduce demand for a volatile and finite commodity and increase the use of more readily available and reliable clean energy sources. Electrification measures should be paired with smart rate design and load flexibility measures to ensure increasing demands for electricity can be met without overinvesting in the electricity system.

An article published in 2021 by the Yale School of Environment debunks many of the myths surrounding reliability and the addition of renewable resources onto the nation’s grids. The piece notes that Germany, where renewables supply 50% of the country’s power, boasts one of the most reliable grids in the world. In 2020, Germany experienced just 0.25 hours of total outages. In contrast, the U.S., where renewable energy and nuclear power each provide roughly 20% of electricity, had five times Germany’s outage rate — 1.28 hours in 2020.

Finally, electrifying buildings and transportation will not happen overnight. In Colorado, electric utilities develop a new resource plan every four years; in these resource plans, utilities project growth in electricity demand and supply solutions. This ensures the utility continues to plan strategically to meet demands, including from new loads from buildings and transportation

Yes. Especially in a time when customers across the West are reeling from high utility bills, ratepayers who face challenges in making the switch to electric appliances should not be left holding the bag to pay off past utility investments, particularly when those investments could have been avoided through alternatives. A utility’s profits come from their capital investments — not fuel costs or operations and maintenance costs. This means that the incentives of a utility’s ratepayers and shareholders are not necessarily aligned, underscoring the importance of robust oversight by utility regulators.

When gas utilities require more revenue to cover spending on new infrastructure, even as their customers rely less on gas, customer rates per unit of gas increase. According to r, if utilities continue spending on gas pipeline infrastructure at the same pace as they do today, base rates could increase to levels that wouldn’t be affordable for the average family.

WRA has proposed several solutions to prevent future utility bill spikes as customers electrify their homes and leave the gas system. In her Top Five Ways to Fix High Gas Bills in the West, Meera Fickling, Building Decarbonization Manager at WRA, explains that to avoid saddling ratepayers with expensive and potentially unnecessary investments in fossil fuel assets, it is critical to require gas utilities to plan proactively, especially given many states’ goals for 100% decarbonization by 2050. Gas utilities should evaluate alternatives to investing in traditional gas pipelines that the utilities and their ratepayers may struggle to pay off in coming decades. These alternatives could include electrification, efficiency upgrades, or demand response measures geographically targeted to fast-growing areas that may otherwise require additional pipeline capacity in future years.

Additionally, gas utilities should begin to depreciate all new gas investments using an assumed lifespan of 30 years. This ensures that ratepayers pay off gas investments by 2050, when states like Colorado have deep decarbonization goals and will have largely transitioned off gas. It also allows us to evaluate the costs of these gas investments more realistically.

With our work earlier this year to help lawmakers in Colorado shape SB-291 (Utility Regulation Act), we advocated that utilities should not continue providing gas line extension allowances, which subsidize new connections to the gas system, leading gas utilities to continue to spend on new pipeline capacity. Utilities also should be prevented from imposing large fees on customers when they choose to disconnect from the gas system. These policy solutions were part of the sweeping changes of the bill, which was signed into law May 8, 2023.

REBATES AND INCENTIVES

REBATES AND INCENTIVES

Incentives are funded from a variety of sources, as they are issued by a myriad of agencies from the federal level to Tribal, county and municipal governments, as well as by some utilities. For example: Denver offers a number of rebates that stack based on the amount of electrification homeowners install, and the state of Colorado offers a tax credit of $1,500 for electric heat pumps. These incentives are funded primarily by local or state taxpayers.

Many gas and electric utilities also offer incentives. Utility customers fund these incentives, but the utility must demonstrate to its regulators that the incentives provide benefits for all customers. For example, providing customers with incentives to install a heat pump or additional insulation may help a gas utility avoid investing in a new gas pipeline, saving all customers money. Additional electricity sales from the deployment of heat pumps can reduce electric rates for all customers.

For the next decade, a key source of funding for state clean energy incentives, rebates and investments will be the federal Inflation Reduction Act. Enacted in 2022, the IRA offers unprecedented investments ($783 billion) in clean energy and drought mitigation in the West. The IRA will be funded through 2032 by several sources, primarily by prescription drug reform, a revised 15% corporate tax rate for companies with $1 billion or more in annual income, and a 1% tax on stock buybacks.

Not only are incentives powerful tools that empower consumers to switch to electric appliances and vehicles more easily, they also serve as upfront investments in our overall decarbonization strategy. This benefits both electric ratepayers – more electric sales puts downward pressure on electric rates – and gas ratepayers by avoiding gas system investments.

To learn more about the IRA and how it helps you save money on electric appliances and vehicles, the non-profit Rewiring America has a user-friendly guide here.

Most electrification incentives are geared toward homeowners, even though about one-third of the country’s households – some 110 million people – live in apartments or rented houses.

Renters face a challenge known in economics as the “split-incentive problem.” Most tenants pay their own utility bills as part of their leases; electrification and efficiency upgrades could reduce energy usage and lower bills for these households. A typical landlord, however, may be unwilling or unable to make more expensive up-front investments in replacement efficient electric appliances or upgrades like air sealing and insulation if these expenses would impact their bottom line.

The split incentive problem has a disproportionate impact on communities of color, as well as households that qualify as low- or moderate-income. Approximately 58% of households headed by Black adults rent their homes, as do nearly 52% of Hispanic- or Latino-led households, according to Pew Research Center’s analysis of census data. About 60% of individuals in the lowest income quartile rent their homes. By contrast, only 10.5% of individuals in the nation’s top income quartile are renters.

Some key rebates that benefit low- and moderate-income renters are the IRA’s home electrification and appliance rebates, and home efficiency rebates. This will cover 100% of electrification project costs up to $14,000 for low-income households and 50% of costs for moderate-income households. And unlike other incentives and rebates, these are point-of-sale discounts. Multifamily buildings may qualify for these rebates as long as more than 50% of their occupants are low- or moderate-income, and Department of Energy guidance requires states to set aside at least 10% of rebate funding for low-income multifamily households.

In addition, there are specific rebates and grants that can be used by landlords interested in beneficial electrification of their properties. These include:

- Home Owner Managing Energy Savings (HOMES). A property might be eligible for $2,000 per unit if the project achieves 20% energy savings, and $4,000 per unit if it achieves 35% savings. These incentives are doubled for low- and moderate-income buildings.

- Department of Housing and Urban Development’s Green and Resilient Retrofit Program. Owners of Section 8 multifamily properties can tap into this $1 billion federal program. This provides direct funding for projects that improve energy efficiency and air quality.

ELECTRIC APPLIANCES

Currently it falls primarily to the consumer to determine what rebates are available for electric appliances and home heating and cooling systems. Some retailers, like Best Buy, Home Depot and Lowe’s, provide online resources that enable customers to check on rebates available for specific electric items.

If you’re interested in purchasing an electric appliance or heating/cooling system and want to know what incentives are available, check with your state’s energy office and your municipality. For example, Colorado’s Energy Office had a dedicated webpage listing available IRA credits. The City of Denver also has a webpage listing the credits it provides for heat pumps, heat pump water heaters, and more. And don’t forget to consult with your local utility. Almost all of the electric utilities in the Interior West offer incentives for heat pumps and weatherization measures. For example, Xcel offers rebates on heat pumps, insulation upgrades, smart thermostats and LED bulbs; Arizona’s Salt River Project offers a $500 rebate on heat pump water heaters.

Contractors play a key role in the path to the wider electrification of homes and businesses. Unfortunately, the country faces a shortage of trained electricians and HVAC workers —particularly contractors who specialize in building electrification. As a consequence, it can be faster and easier to replace old or broken fossil fuel appliances with the same type rather than switching to an electric version.

Both federal, state and local governments and private companies are working to solve these challenges. For example, Colorado-based Elephant Energy partners with vetted contractors to work with homeowners who want to update their homes to use electric appliances. And contractors in Colorado can take advantage of a new Colorado State tax credit and sales tax exemption for heat pumps and heat pump water heaters that went into effect Jan. 1, 2023, to market these appliances to customers. The tax credit (10%) and sales tax exemption (2.9%) add up to an additional 12.9% discount on the price of the equipment.

Increased spending on workforce training by utilities could make a significant impact on the accelerated transition to electric appliances. In the new report A Path to Pollution-Free Buildings: Meeting Xcel’s 2030 Gas Decarbonization Goals, published by WRA, NRDC and SWEEP, we found that robust, consistent utility investments along with workforce development and customer education will be critical for Xcel to meet Colorado’s 2030 greenhouse emissions reduction goals.

On contractor outreach and marketing, we look to Maine as a model. Contractors there installed close to 30,000 heat pumps and 10,000 heat pump water heaters per year in 2021 and 2022. One key to Maine’s success is that incentives are paid to contractors quickly — within days, not months. Efficiency Maine reports that 98% of incentives in the state are paid out within two weeks.

In 2019, Maine set a goal of installing at least 100,000 heat pumps, cumulatively, by 2025 — and recently achieved this goal two and a half years ahead of schedule. In fact, they have been so successful that the state recently set a new goal of deploying another 175,000 heat pumps by 2027. In the past four years, they’ve achieved annual sales growth of 50% to 100% every year, which is exactly what Xcel needs to do over the next few years to successfully meet Colorado’s requirements.

Many of the federal and state incentives available for electric appliances are provided in the form of tax credits. These are often inaccessible to low- and moderate-income families without sufficient tax liability. It is especially critical that low-income families, as well as renters, be able to access efficient electric appliances. Because low- and moderate-income households are more likely to live in geographic areas with poor outdoor air quality, the indoor air quality benefits of electric appliances are critical. Heat pumps can also help these households access air conditioning during increasingly hot summers.

In our recent report A Path to Pollution-Free Buildings: Meeting Xcel’s 2030 Gas Decarbonization Goals, we recommend that at least 20%-25% of Xcel’s clean heat budgets be dedicated toward incentives for the utility’s low-income customers. And as the market for heat pumps develops, Colorado’s Public Utilities Commission should consider increasing the overall budget for income-qualified customers to 40%. This would align with the federal government’s Justice40 initiative, an executive order signed by President Joe Biden to have 40% of the overall benefits of certain federal investments flow to “disadvantaged communities that are marginalized, underserved, and overburdened by pollution,” according to the White House’s guide to the order.

For income-qualified households, we also recommend pairing electrification with deep energy efficiency retrofits to maximize bill savings and allowing these customers to finance projects using their electricity bills. Various incentive programs, such as the utility and IRA rebate programs previously highlighted, as well as financing options such as on-bill financing for upgrades, should be streamlined to ensure easy access for low-income households.

Xcel, which funded the report assembled by the National Renewable Energy Laboratory (NREL), has not made the study public. The report is not final and studies only one heat pump model, and it was also not included in Xcel’s Clean Heat Plan filing in August 2023. According to media coverage, the report found a minor decline in heat pump efficiency at Colorado’s Front Range altitude. Gas furnaces also perform more poorly at altitude than they do at sea level.

Claims that heat pumps don’t perform well at altitude, or in the cold, might come as a surprise to those Coloradans whose heat pumps performed well through the Dec. 22, 2022 cold snap experienced along the Front Range. The Colorado Sun, for example, interviewed homeowners whose heat pump functioned and maintained thermal comfort even as temperatures reached 18 degrees F below zero. Journalist Sam Brasch of Colorado Public Radio tweeted a picture of his thermostat holding steady at 69 degrees Fahrenheit, in temperatures well below zero. Contractor Elephant Energy used SmartAC sensors to collect data on their customers’ cold-climate heat pumps’ performance during this period, finding that all customers studied were able to maintain a desired setpoint above 65 degrees, with many systems maintaining a temperature above 70 degrees.

In response to the purported findings of the Xcel report, David Petroy, whose company NTS Energy designs heat pump systems for homes and businesses, told the Colorado Sun that HVAC contractors “routinely correct for altitude.”

WRA looks forward to reviewing Xcel’s report when available.

A study by SWEEP found that the total greenhouse gas emission reductions from heat pumps alone compared to gas furnaces are about 49% for new homes, including the indirect emissions involved associated with those homes’ increased electricity consumption. Homes with heat pump water heaters reduce GHG emissions by 68%. The study’s authors also found that a home with a rooftop solar PV system will have even lower GHG emissions from heating and cooling.

A separate study by RMI found that in Denver, an all-electric home saves $2,900 in net present costs and 12 tons of GHG emissions over a 15-year period. In addition, according to SWEEP’s study, an all-electric new home costs about the same to build as a mixed-fuel home with natural gas or propane for heating, hot water, and cooking.

Additional Resources on Building Electrification